Welcome to Yorkshire

Published on May 19th, 2025

•Most of us probably wish we’d been taught more about money when we were younger. Things like budgeting, saving, or even what interest actually means stuff that hits hard once real life starts kicking in. So it’s no surprise that parents are now backing a push to get proper financial education into schools.

The Yorkshire Building Society has been doing just that. They've run sessions with kids across the UK, including over 665 children and teens in Warrington, helping them learn about money in fun, hands-on ways. But now, they’re stepping it up they want the Government to officially make this kind of learning part of every school’s curriculum.

Let’s take a look at what they found and why it matters, not just for kids, but for families everywhere.

Image source: https://www.warringtonguardian.co.uk/news/25165932.yorkshire-building-society-financial-education-needed/

Most parents want this—but aren’t talking about money enough

The research from Yorkshire Building Society shows something kind of ironic. Over 90% of parents say financial education is really important for kids. Nearly all of them 89%, to be exact think it should be taught in schools.

But here's the twist: even though parents say it matters, only a quarter of them actually talk to their kids about money more than once a week.

So, what’s the hold-up?

Maybe it’s awkward. Maybe they don’t feel like experts themselves. Or maybe life just gets in the way. Either way, there’s a clear gap between what parents believe and what actually happens at home.

Kids are already forming money habits by age seven

Yep, you read that right. According to the research, kids start building their attitude toward money as young as three, and their saving habits are pretty much set by age seven. That's younger than most of us would expect.

Imagine this: a six-year-old who’s never been shown how to save or told what money’s for. That child could be carrying that mindset all the way into adulthood. And that’s what Yorkshire Building Society is trying to change with actual lessons, not just lectures.

The Money Minds programme is already making a difference

You might be wondering, "Alright, but what are they actually doing?" Good question.

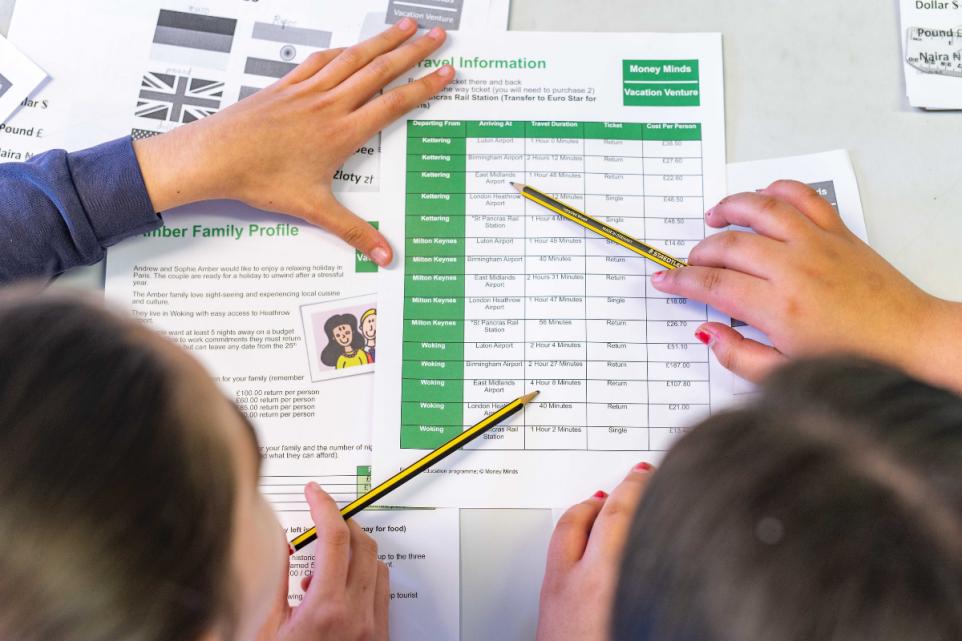

So far, over 16,000 young people across the UK have taken part in lessons from the Money Minds programme. These aren't just boring PowerPoints either. Kids get to do interactive activities and talk about real-life situations, things like:

- How to keep money safe

- Budgeting basics

- What borrowing actually means

- Spotting scams (because online fraud is a big deal now)

- Understanding how relationships can affect money

- What employers look for in job candidates

And the resources aren’t just for teachers. There’s an online platform with free tools for parents, teachers, and young people aged 11 to 19.

Parents prefer real-life stories over tech

When it comes to teaching their kids about money, 70% of parents say they rely on personal experiences. Maybe that’s a story about a time they blew their savings on a dodgy car, or how they finally figured out how credit cards really work.

Only 29% use apps. And fewer still 27% turn to YouTube or online content.

So clearly, real talk still wins over tech when it comes to teaching kids about money.

But there’s still a big gap in financial confidence

Here’s a quick breakdown of what parents say they care about—and what they actually do:

| Financial Topic | % of Parents Who Say It's a Priority | % Who Actually Talk About It |

|---|---|---|

| Saving | 80% | Not specified |

| Budgeting | Not specified | 68% |

| General money talk (weekly) | Not specified | 25% |

It’s clear that while parents want to raise money-smart kids, they often don’t know where to start—or just haven’t found the time.

Calling on the Government to make it official

This isn't just a nice idea for Yorkshire Building Society. They’ve actually submitted official recommendations to the Government’s Curriculum and Assessment review, asking that financial education be made mandatory in all schools.

The Government is expected to publish its final review recommendations in autumn 2025.

Chris Irwin, who’s Director of Savings at Yorkshire Building Society, put it simply:

“This research shows that parents recognise that financial education is incredibly important.

We hope that the Government will increase the focus on financial education in schools – and make it mandatory for all pupils across the country so no child misses out on developing important life skills relating to money.”

So what’s the takeaway?

Here’s the thing money affects everything. Whether it’s deciding what snack to buy or working out how to pay rent, these skills don’t just appear out of nowhere. We have to learn them somewhere.

The Money Minds programme is doing its bit. And now, they want the Government to step in and make sure every child gets that same chance no matter where they live or what their parents know about money.

And if you’re a parent reading this? It might be worth starting that chat about money tonight even if it’s just explaining how you plan the weekly shop. Because it all counts.

Yorkshire Team

The Yorkshire.com editorial team is made up of local writers, content creators, and tourism specialists who are passionate about showcasing the very best of God’s Own Country. With deep roots in Yorkshire’s communities, culture, food scene, landscapes, and visitor economy, the team works closely with local businesses, venues, and organisations to bring readers the latest news, events, travel inspiration, and insider guides from across the region. From hidden gems to headline festivals, Yorkshire.com is dedicated to celebrating everything that makes Yorkshire such a special place to live, work, and visit.

View all articles →

Comments

0 Contributions

No comments yet. Be the first to start the conversation!